EUR/USD Price Analysis: Defends 1.2000 but bears stay hopeful

- EUR/USD struggles to overcome the heaviest daily losses in a year.

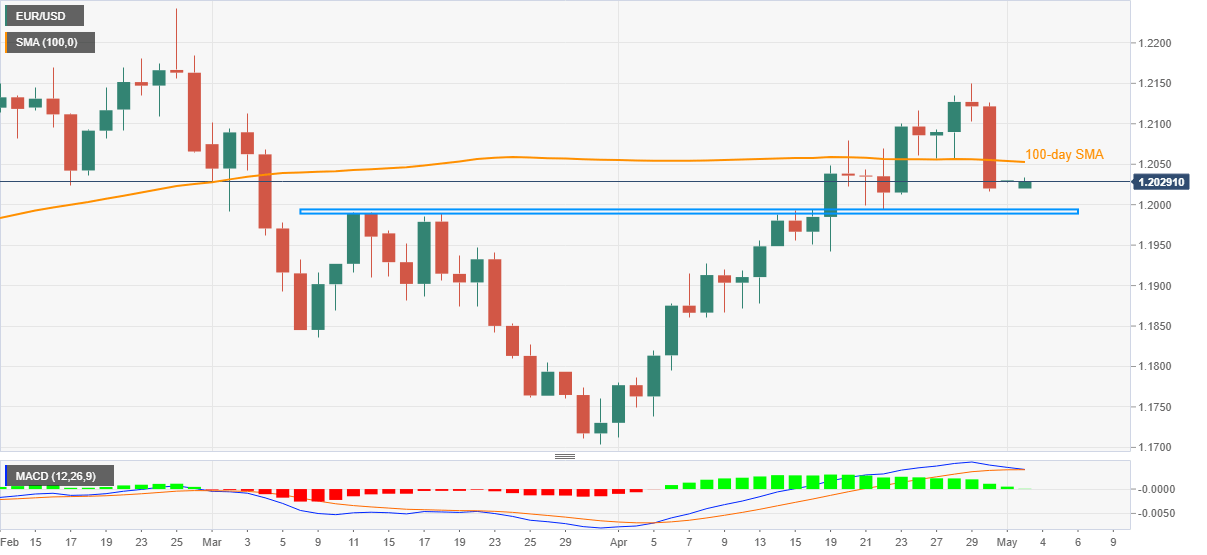

- Receding bullish bias of MACD, 100-day SMA breakdown direct sellers toward seven-week-old horizontal support.

- Bulls need a daily closing beyond 1.2100 to retake control.

EUR/USD holds lower ground, despite the latest bounce to the north, around 1.2030 amid the initial Asian session on Monday. In doing so, the currency major pair keeps Friday’s downside break of 100-day SMA amid weakening MACD bullish bias.

Against this backdrop, EUR/USD sellers keep their eyes on a horizontal area surrounding 1.1990 that comprises multiple levels marked since March 11. However, any further downside becomes doubtful at the moment.

Should the quote drops below 1.1990 on a daily closing basis, 1.1930 and 1.1870 levels are likely to return to the chart.

On the contrary, a daily closing beyond the 100-day SMA level of 1.2052 will look to cross the 1.2100 hurdle to keep EUR/USD buyers hopeful.

Following that, April’s low 1.2150 and the yearly peak close to 1.2245 will be important to watch.

EUR/USD daily chart

Trend: Further weakness expected