USD/JPY Price Analysis: Bounces off 50-bar SMA with limited upside scope

- USD/JPY consolidates the recent losses.

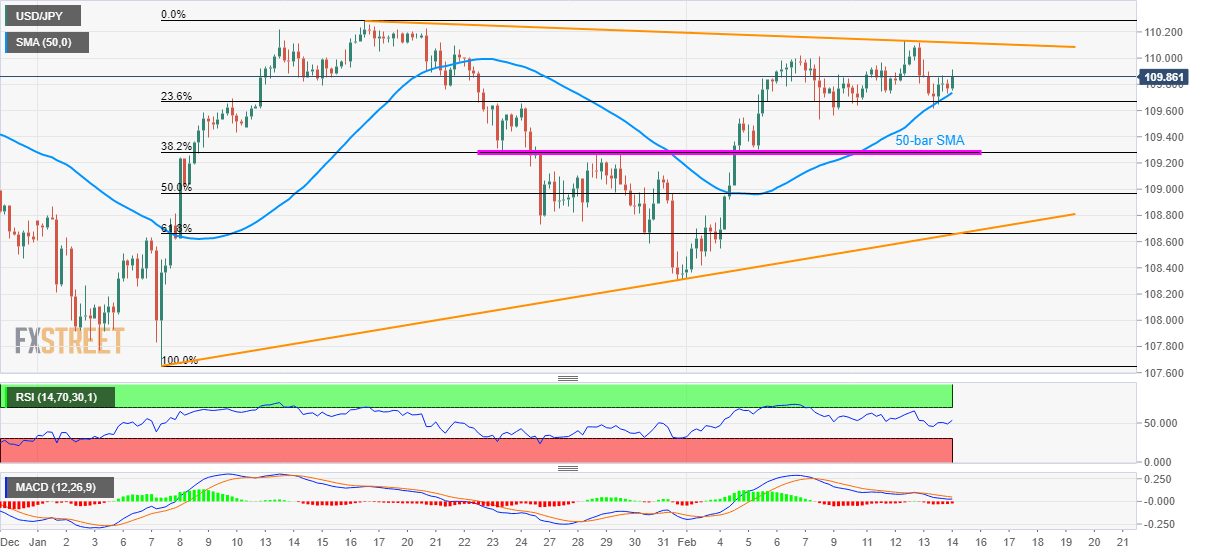

- A downward sloping trend line since January 17 guards immediate upside.

- Technical indicators suggest bearish momentum holding strong despite the pullback.

USD/JPY rises to 109.86, following the uptick to an intra-day high of 109.91, during the early Friday. In doing so, the quote recovers the previous day’s losses while taking a U-turn from 50-bar SMA.

While the current upside rush highlights a monthly falling trend line resistance, at 110.12, the quote’s further advances are likely to be tamed considering bearish MACD and normal RSI.

In a case buyers manage to cross 110.12, January month high near 110.30 holds the key to pair’s run-up towards May 2019 top surrounding 110.70.

On the downside, 50-bar SMA of 109.73 and a horizontal area comprising 38.2% Fibonacci retracement of January month upside near 109.30 can restrict the quote’s short-term declines.

During the pair’s declines below 109.30, 108.70/65 becomes important as it includes an ascending trend line from January month low and 61.8% Fibonacci retracement level.

USD/JPY four-hour chart

Trend: Pullback expected