Back

15 Jan 2020

Copper Futures: extra gains likely near-term

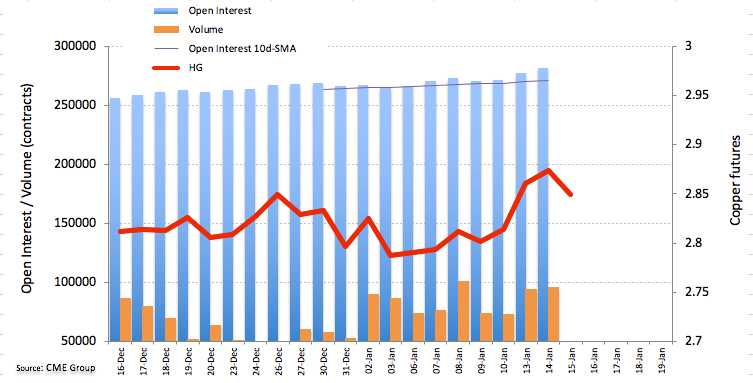

According to preliminary readings from CME Group for Copper futures markets, open interest rose for the third session in a row on Tuesday, this time by almost 3.8K contracts. Volume, in the same line, went up by around 2.1K contracts, clinching the second consecutive build.

Copper pose to tackle the 2.86 mark

Copper prices are now grinding lower after hitting YTD highs in the boundaries of he 2.86 mark on Tuesday along, reaching at the same time the vicinity of the overbought territory, as per the Relative Strength Index (RSI). The positive price action coupled with rising open interest and volume and the risk-on environment should favour the continuation of the bullish move to, initially, the 2.86 neighbourhood.