What is the interest coverage ratio?

Types of interest coverage ratios

Why and when the ICR is important

Interpretation of the interest coverage ratio

What is a good interest coverage ratio?

Imagine you run a business. Recently, you decided to expand it by hiring new employees and purchasing new equipment. However, since you do not have enough resources, you resort to securing a loan. The question remains whether you can repay the loan and interest. How can you determine this? A special model called the interest coverage ratio can help one visualise a company's financial state and understand the amounts one can borrow as a business owner. Let's take a deeper look into the details.

Simply put, the interest coverage ratio is a financial model that shows how easily a company can pay the interest on its debt. This model doesn't count the loan principal, giving a somewhat limited vision of the company's financial stability. Here are some key features of the model: The interest coverage ratio is a specific number you calculate using a formula. Depending on your business' niche, this number will show your real ability to repay your loan interest. For example, your ICR can be 2.3.What is the interest coverage ratio?

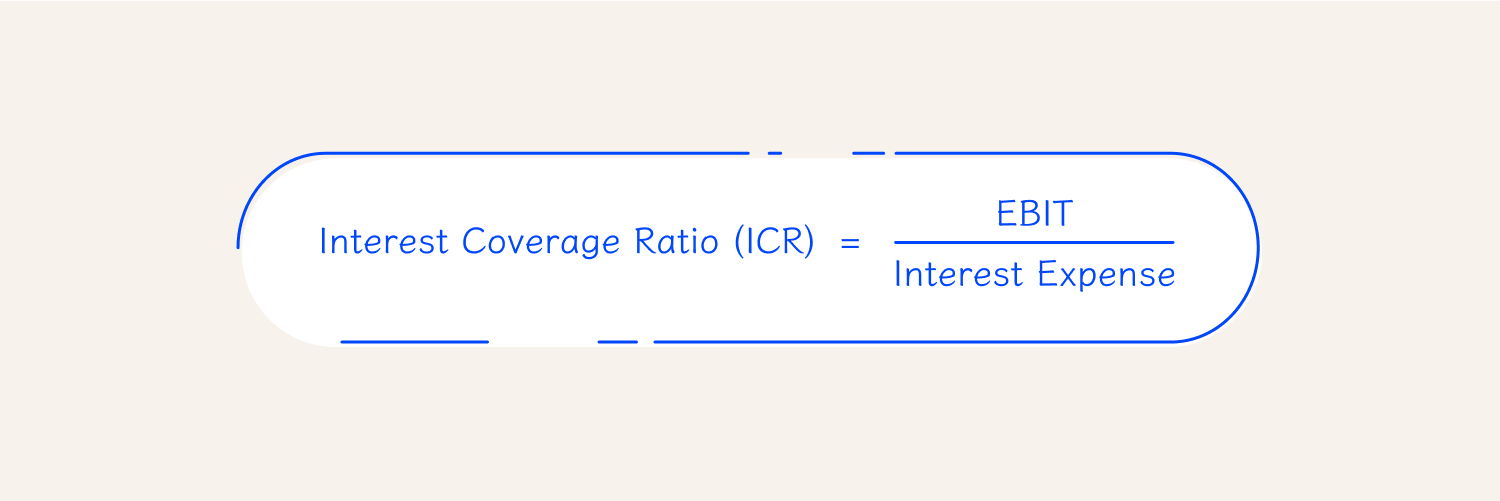

The interest coverage ratio is calculated with the following formula:How to calculate the ICR

Let's break it down:

- EBIT is an abbreviation for earnings before interest and taxes. This is the amount a business earns from its regular activities before paying the loan interest and taxes.

- Interest Expense (Total Interest Amount) is the whole sum of the interest that a company will need to repay within the entire loan term.

Usually, ICR is calculated for a month, year, or quarter, depending on the company's repayment plan.

Let us consider an example:

Imagine you own an online electronics store. Your EBIT per month is $10,000—this is your revenue minus the costs of the electronics you sold, taxes, and operating expenses.

You took a loan to purchase new goods for your store. The total interest expense on this loan is $2,000. Using the formula, you get the following:

.png)

The result is exactly your ICR. It means you can pay your interest expense 5 times with the money you make from selling electronics. And, running a bit ahead, this is a pretty good ICR for the online selling niche.

Another example:

A big IT company has ended up with a negative EBIT for the past year. It means the company had more expenses than revenue. The EBIT was –$50,000. The interest expense for a supposed loan is $50,000.

In this case, the ICR is –1, which means the company won't be able to repay the interest, at least not now.

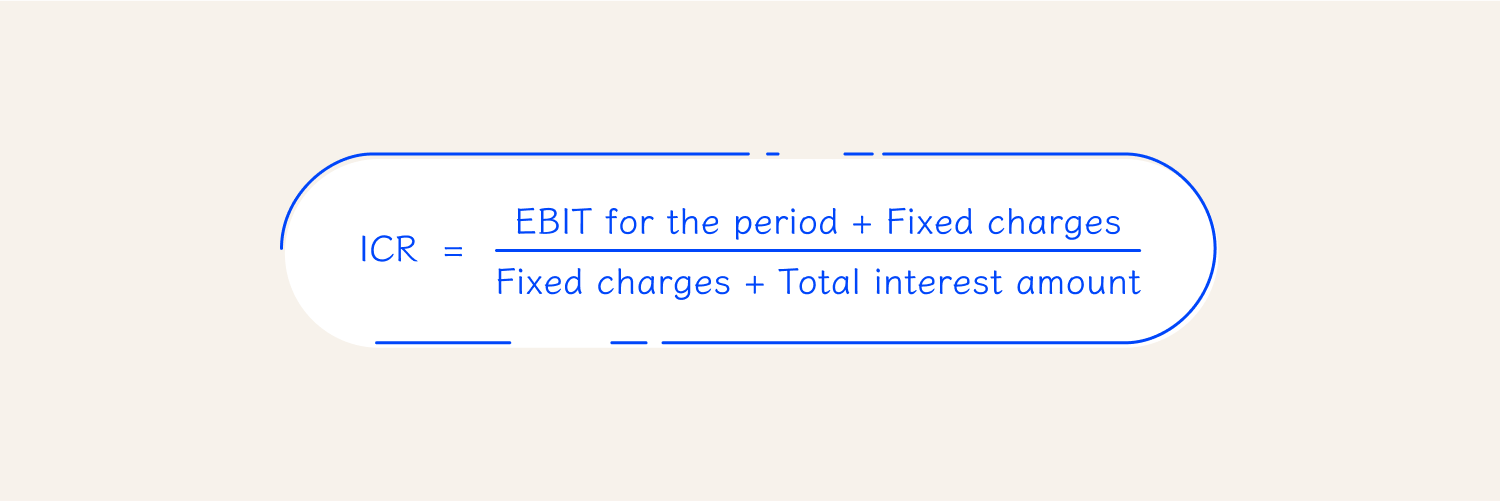

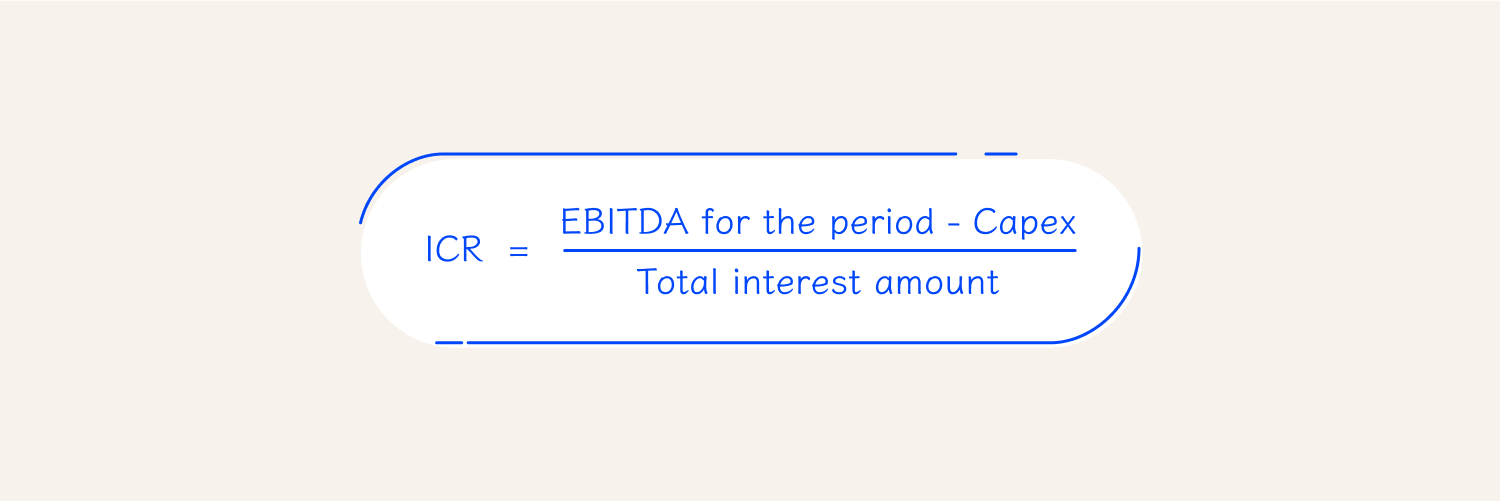

The interest coverage ratio formula with EBIT indicated above is the most straightforward and common. However, you need more insights about the company's ability to repay the interest. Here are situations using other types of ICR can provide these additional insights: EBITDA interest coverage ratio formula:Types of interest coverage ratios

.png)

- Fixed Charge Coverage Ratio. This interest coverage ratio is broader: it includes all the fixed payments alongside the interest. It helps estimate a company's overall ability to meet its fixed financial obligations.

- EBITDA Less Capex interest coverage ratio. With the help of this ratio, you can count money spent on maintaining or growing the company—Capital Expenditure, or Capex. It shows how well a company can pay its interest after these investments.

Businesses calculate the ICR when they need to estimate the ability to repay outstanding debt's interest. Besides being an evident part of risk management before taking a loan, counting ICR is also important in the following situations: This metric is also helpful for traders and other market participants, who want to take out a loan and need to understand if they will be able to repay it.Why and when the ICR is important

So, you calculated the ICR Ratio and got a particular number. What does this number mean, and how can it help you make confident decisions? We will discuss this further. There are no universal figures for an ICR. Depending on your business's niche, the 'good' ratio might vary from very small to pretty big numbers. A general benchmark is 3 or higher. ICRs are not usually very high and rarely exceed 30. Here are some general guidelines: To give you some understanding of the numbers, we will show you the average ICRs among the U.S. companies by industry according to Readyratios.com: Note: The figures can change from year to year and shouldn't be considered the ultimate basis for estimating your company's actual ICR.Interpretation of the interest coverage ratio

What is a good interest coverage ratio?

Food

2.89

Furniture and fixtures

9.80

Primary metal industries

7.71

Hotels and other lodging services

2.52

Automotive repair, services, and parking

4.71

Educational services

3.76

Final thoughts