Difference between Buy Limits and Buy Stops

Buy Limit—Buy Stop dilemma: which one is better?

This article is a valuable resource for both novice and experienced traders, as it provides a comprehensive understanding of pending orders. We'll focus on buy-limit and buy-stop orders and explain their key differences, equipping you with the knowledge to make informed trading decisions.

What is a buy limit?

A buy limit is a pending order that is usually below the price. It is used when the trader anticipates that the trade will pull back before continuing with the bullish trend, as explained below.

Buy limit example: a trader anticipates the trade to retrace and activate the order. It is like a discounted entry, where the trader gets a better price to go long.

Example

Buy-limit orders help you avoid rushing into buying when prices are high. In trading jargon, these orders are called 'improvement orders' since they allow traders to secure a better price than the current one.

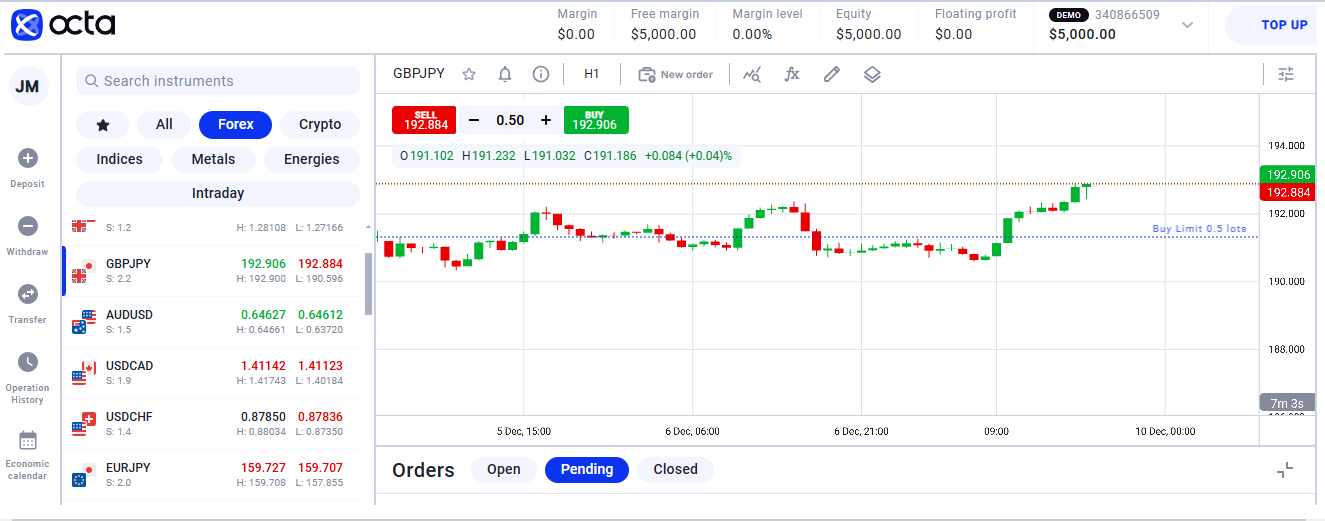

The example above shows a buy-limit order. Suppose the trader forecasts that the market—in our case, GBPJPY—is bullish. However, the trader anticipates that the GBPJPY will retrace before continuing with the bullish trend. In that case, the trader would place a buy-limit order, as shown above. The stop loss goes below the limit order.

The Buy Limit is under the pending tab. The trader can cancel the placed order or adjust the price based on his strategy and analysis.

When to use buy limit

Here's when and why to use Buy Limits effectively:

- Expecting pullback. If you anticipate that the price of an asset will retrace, placing a buy-limit order allows you to buy at a lower price than the current market rate.

- Controlling a purchase price. Buy-limit orders ensure traders do not pay more than their desired price in volatile markets where prices fluctuate rapidly.

- Market gaps. A buy-limit order can capture a better price than anticipated when an asset price might gap down—open significantly lower than its previous close.

- Trading strategy alignment. Buy limits are beneficial for implementing specific trading strategies, such as buying on pullbacks during an uptrend. Traders can identify key support levels and set buy-limits below them to maximise their entry points while minimising risks.

- Avoiding emotional trading. Using buy-limit orders can help traders remain disciplined and patient, reducing the temptation to chase prices in fast-moving markets. This approach fosters better risk management and can enhance overall trading performance by focusing on strategic entry points rather than reacting impulsively.

What is a buy stop?

A buy-stop order is a pending order placed above the price; in this case, the trader anticipates the market will continue bullish beyond a certain level.

The buy-stop orders are usually set above key levels where traders anticipate that if the market goes up, it will continue with the trend. For instance, we can place a buy-stop above a key resistance level where a breakout would activate the order to continue with the trend.

Example

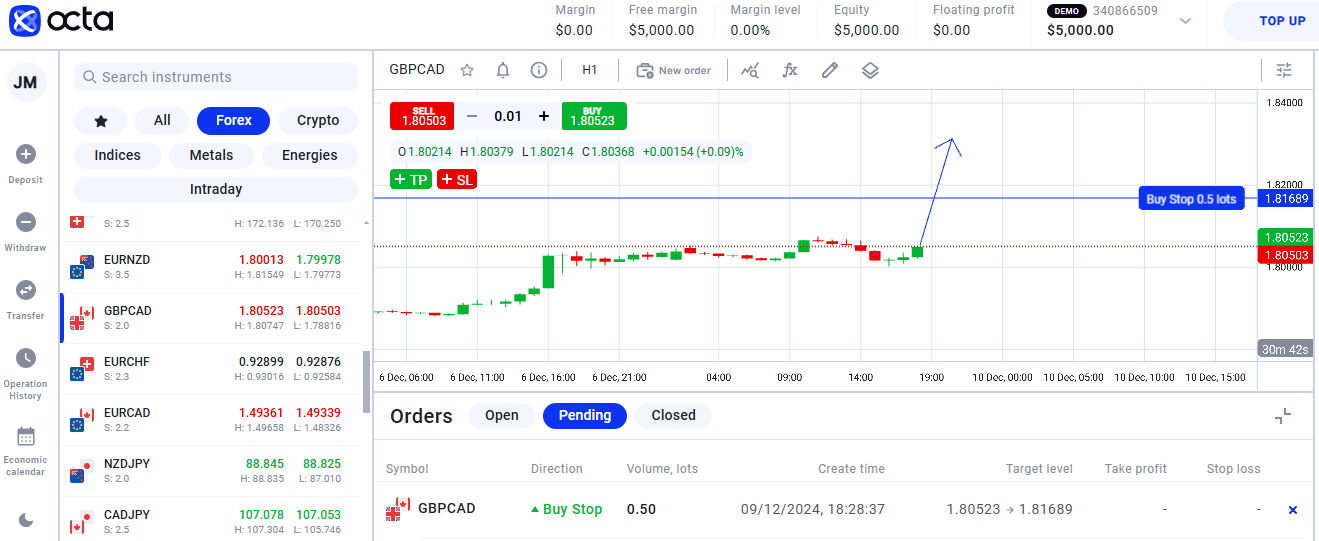

The chart below shows the buy stop usage. The trader places a buy-stop order above the current price, projecting that the price will continue to be bullish beyond a certain price.

When to use buy stop

Here are some scenarios where using a buy stop order is advisable:

- Capitalising on breakouts. Buy-stop orders are helpful for traders looking to profit from breakouts. When an asset approaches a resistance level, placing a buy-stop order just above that level can allow you to enter the market as soon as the price breaks out, potentially capturing significant gains if the upward momentum continues.

- Managing short positions. Traders who hold short positions can use buy-stop orders as a risk management tool. By placing such an order above their short sale price, they can limit potential losses if the market moves against them, which is especially critical in volatile markets where prices fluctuate rapidly.

- Enhancing trading psychology. Using Buy Stops allows traders to avoid emotional decision-making by automating entry points. This reduces the need for constant price monitoring and helps prevent impulsive trades based on fear or greed.

Difference between buy-limits and buy-stops

The significant differences between these two order types are given in the table below:

| Order name | When to apply | Trigger point | Price movement |

| Buy limit | You use buy limit when you want to buy something but only at a lower price than its current trading price. | You set a maximum price. Your order will only be executed if the cost exceeds this amount. | It's suitable for situations where you want to buy at a discount or wait for the price to drop before buying. |

| Buy stop | You use buy stop when you anticipate increasing the asset's price. | You set a specific price. Your order will automatically trigger if the price exceeds this amount. | It's suitable for situations where you want to confirm the price is trending upward before buying. |

Buy limit—buy stop dilemma: which one is better?

The decision between buy limit or buy stop hinges on your trading strategy and the prevailing market conditions. A buy-limit order is beneficial when you expect the price of a currency pair to dip to a certain level before making a recovery. This tactic is helpful if you've pinpointed support levels, helping you to enter the market at the most favourable price.

Conversely, a buy-stop order is a strategic move when you foresee that the price will continue to increase after surpassing a particular resistance level. Setting a buy-stop order above the current market price allows you to take advantage of upward momentum once the price hits that mark. This method can be particularly effective in trending markets, where confirming a price breakout may lead to substantial profits, making you feel more strategic and forward-thinking in your trading.

Your choice between buy limit and buy stop should reflect your market analysis and trading objectives. Each order type serves unique purposes in various trading contexts, and understanding this will make you feel more informed and strategic in your trading decisions.

Final thoughts

- A buy-limit order allows traders to acquire an asset at a specified price or lower, helping them avoid overpaying.

- In contrast, a buy-top helps traders to buy an asset only once its price exceeds a certain threshold, indicating potential further increases.

- Both order types serve unique purposes and can be advantageous depending on market conditions and individual trading strategies.

- Buy-limit orders seek better pricing when a market decline is forecasted, and buy-stop orders capitalise on upward trends when prices rise.

- Traders should evaluate their goals and risk tolerance when deciding which order type to use.