What is a Marubozu candlestick?

How to identify Marubozu candlestick patterns

How does a Marubozu pattern work?

How do you trade using a Marubozu trading pattern?

The Marubozu candlestick, while relatively obscure among Forex traders, is easy to recognise once you understand its key characteristics. Its infrequent appearance on charts does not diminish its significance. Once you identify this pattern, you can confidently assess the strength of its signal by considering its position within the broader trend.

The Marubozu candle is a unique candlestick pattern in technical analysis, characterised by its singular structure and absence of shadows, which convey strong market sentiment. The term 'Marubozu', derived from Japanese, translates to 'bald' or 'shorn', aptly describing its appearance—this candlestick appears as if its tails have been 'trimmed', resulting in a clean, uninterrupted body.What is a Marubozu candlestick?

1. Marubozu

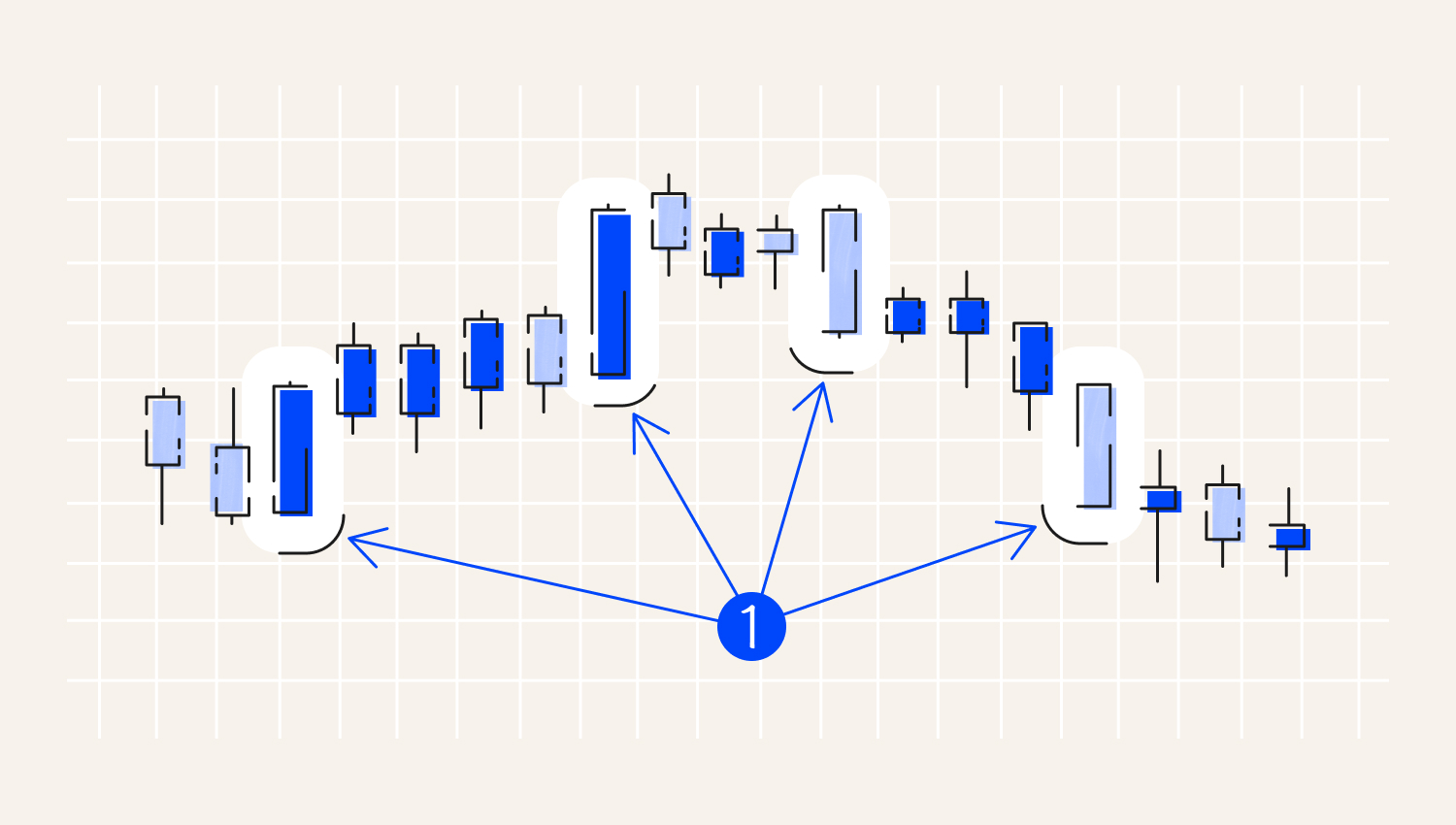

Traders classify the Marubozu candle depending on whether it has a tiny wick and where. Let's examine the three types of Marubozu candle patterns.How to identify Marubozu candlestick patterns

The Marubozu candlestick signals robust market sentiment and momentum in a specific price direction. Its effectiveness lies in its precise representation of market psychology, providing traders with unmistakable signals that are particularly accessible even to those new to trading. The Marubozu pattern serves as a barometer for market sentiment. A bullish pattern suggests overwhelming buying pressure, while a bearish candlestick indicates intense selling pressure. This clarity helps traders gauge the prevailing market mood and make informed decisions. However, it is essential to remember that Marubozu should not be viewed in isolation. We should analyse the pattern in the context of other technical indicators and chart patterns to confirm market sentiment. This rule applies to every instrument used in market trading. In addition, the chances of success of any candlestick vary depending on the market situation, timeframe, and trading strategies. Marubozu patterns have a probability of success of approximately 65–70% when used with other technical indicators and price movement analysis. However, no trading strategy or indicator can guarantee profits, so traders should always apply adequate risk management techniques and follow their trading plan.How does a Marubozu pattern work?

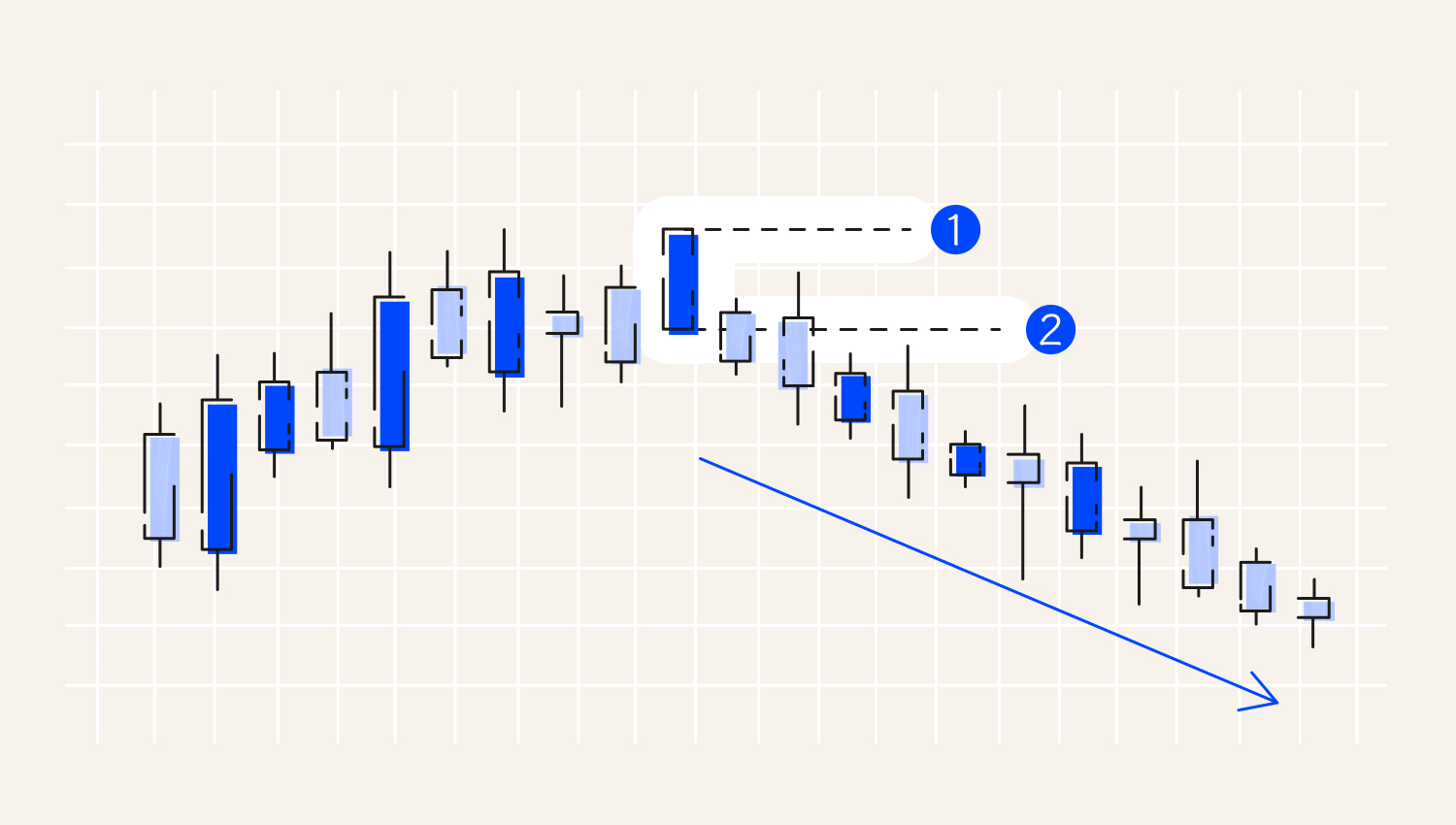

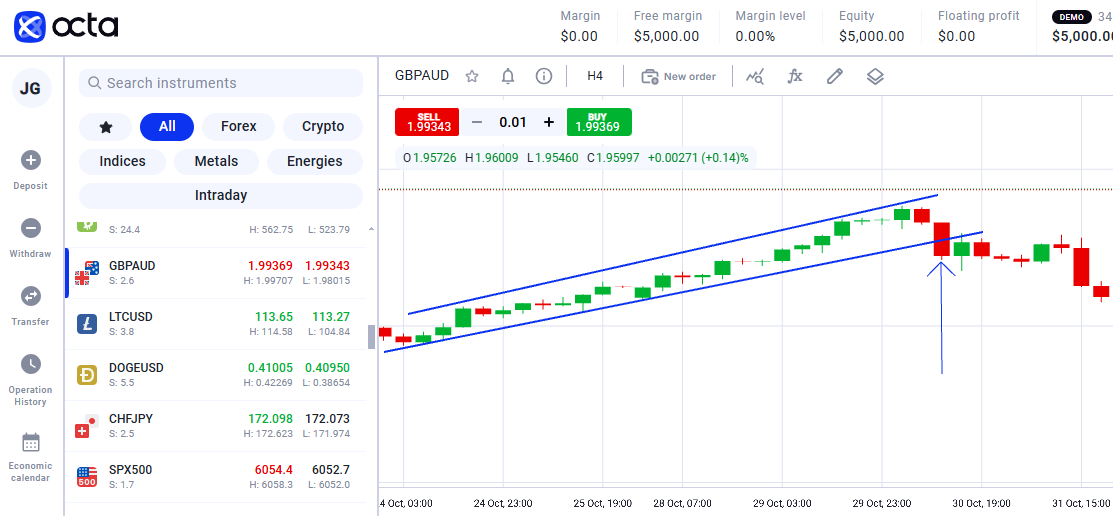

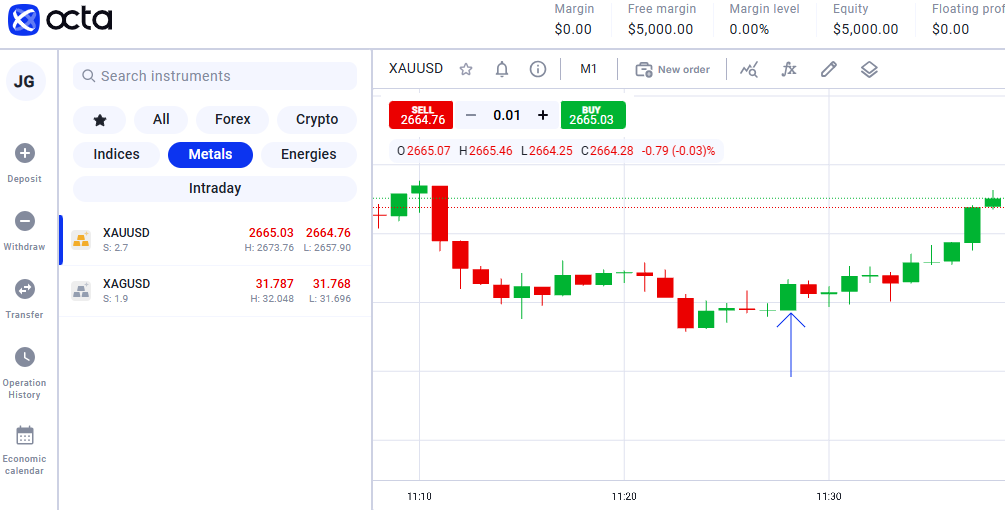

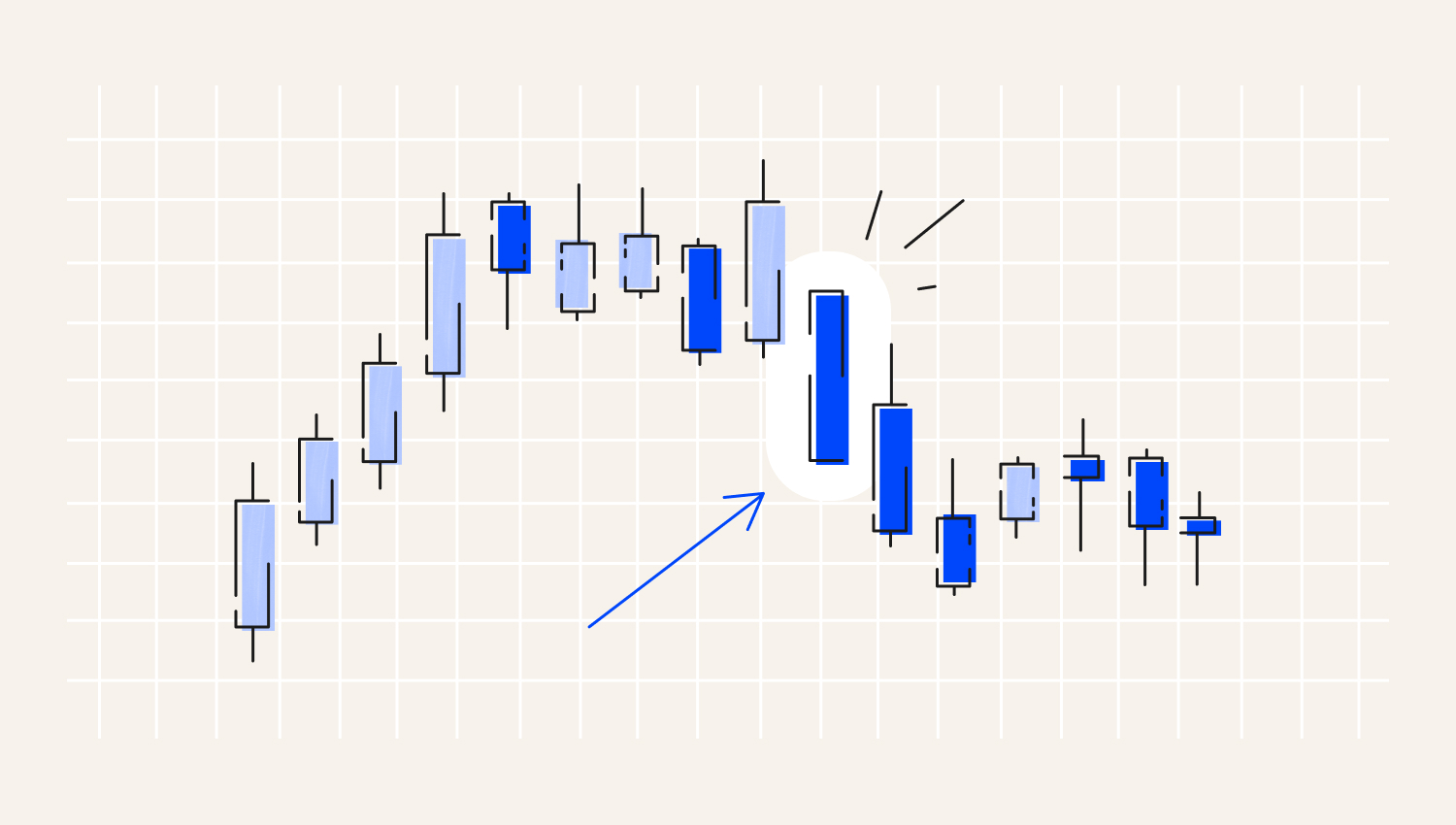

According to the trend direction, we identify the following varieties: Let's dwell on these types of patterns in more detail. The bearish Marubozu primarily indicates a strong bearish sentiment in the market. This pattern typically appears after an uptrend, suggesting a potential reversal or continuation of a downtrend. The example below shows a bearish Marubozu Close after the price broke the channel.Types of Marubozu candles

Bearish Marubozu

1. Stop loss

2. Entry level

It has a long body with no upper or lower shadows, indicating that the opening price is equal to the high and the closing price is equal to the low or has a lower wick. This pattern signifies that the seller dominated the trading session, reflecting intense selling pressure and a lack of buying interest.

The presence of a bearish Marubozu indicates strong downward momentum, suggesting that prices are likely to continue falling. It can also show a shift in market sentiment from bullish to bearish, which can lead to further price declines.

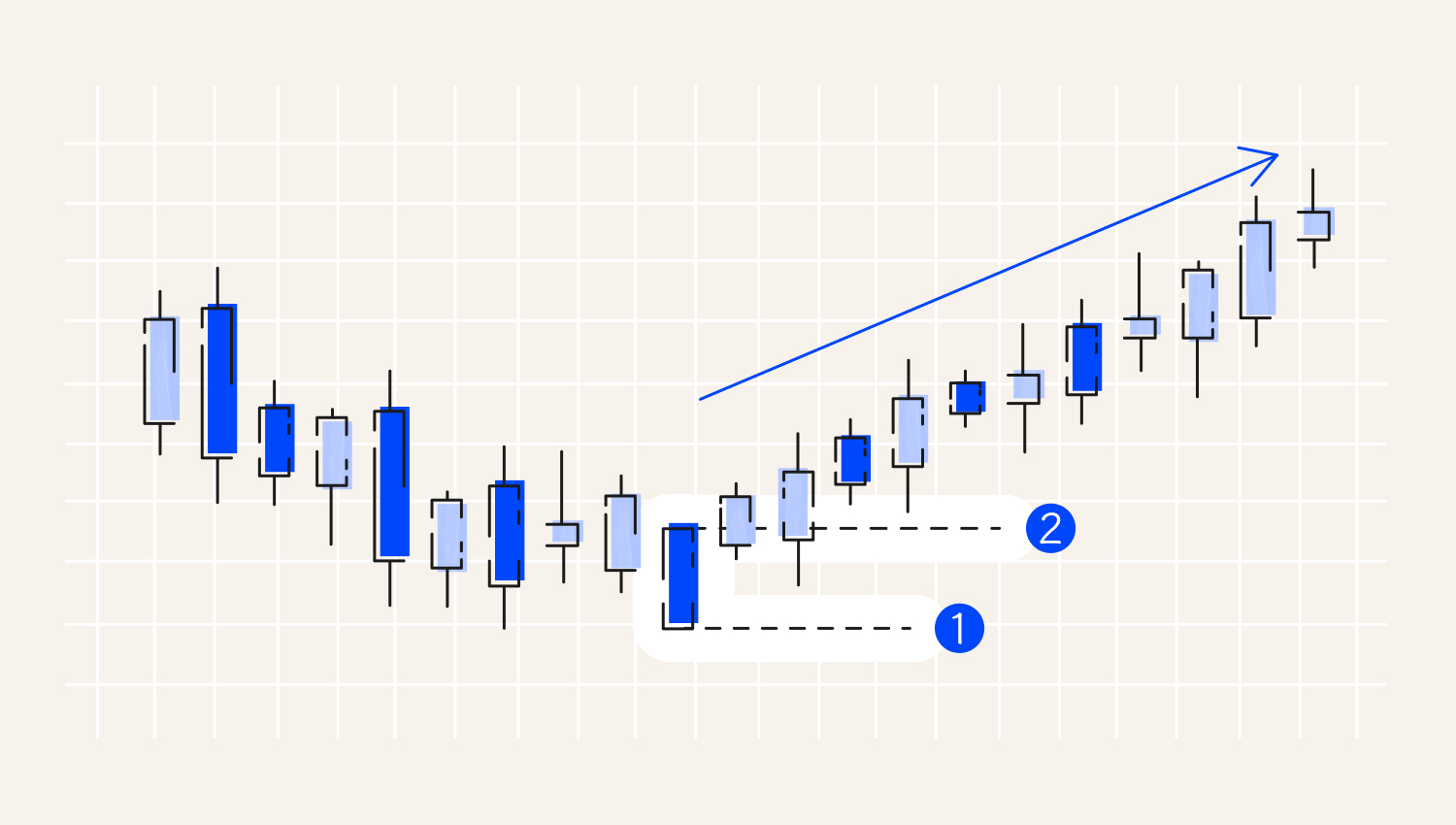

Bullish Marubozu

The bullish Marubozu candlestick pattern has small or no upper and lower shadows. This pattern indicates a strong demand for the asset in the market or that market participants are willing to pay any price to buy it during the trading session.

1. Stop loss

2. Entry level

In this regard, the trader should look for entry points to buy after seeing a bullish candle. The entry level should be slightly above the closing price of the bullish Marubozu.

The Marubozu candlestick is one of the most reliable candles in technical analysis. It is an effective intraday trading tool, allowing you to determine the dominant side of the market—buyers or sellers. However, the effectiveness of this candlestick may vary depending on the current market situation. Also, like any other technical pattern, the Marubozu has advantages and disadvantages. Advantages: Disadvantages:Advantages and disadvantages

The Marubozu pattern indicates a strong market trend. If the candle is bullish, it suggests that buyers are in control, which signals buying. If the candle is bearish, sellers dominate the market, which signals to exit or sell. To trade successfully, you must do the following:How do you trade using a Marubozu trading pattern?

It is important to remember that trading should be comfortable and informed. Before investing money, one must carefully analyse the market, develop a trading strategy, and conduct research.

Trading Marubozu patterns requires discipline and confirmation, as their clear signals can lead to profitable trades with proper risk management.

Final thoughts