How to trade using Fibonacci levels

Trend continuation strategy using Fibonacci retracements

Confirmation from secondary indicators

Looking at the trend across multiple time frames

How to enter the Forex market using the Fibonacci trading strategy

Take-profit and stop-loss levels

In the first part of the article, we discussed the origin of the Forex Fibonacci sequence, which was originally presented along with the Hindu–Arabic numeral system in the book 'Liber Abaci' by Leonardo Pisano, nicknamed Fibonacci. In Fibonacci's original sequence, each number is the sum of the two previous numbers: 0, 1, 1, 2, 3, 5, 8, 13, 21, 34, 55, 89, 144, 233, 377, and so on. Dividing one number by the number that follows creates the 'Golden Ratio' (φ=1.618), for instance: 8/13 = 61.53%, 34/55 = 61.81%. The 23.6%, 38.2%, 50%, and 61.8% Fibonacci levels play an important role in the financial markets. They are used to define critical points that cause price reversals. Fibonacci retracements help indicate strategic places for market entries and stop losses, as well as determine areas of support or resistance. This second part covers arguably the most powerful and easy-to-understand application of Fibonacci in trading on the Forex market.

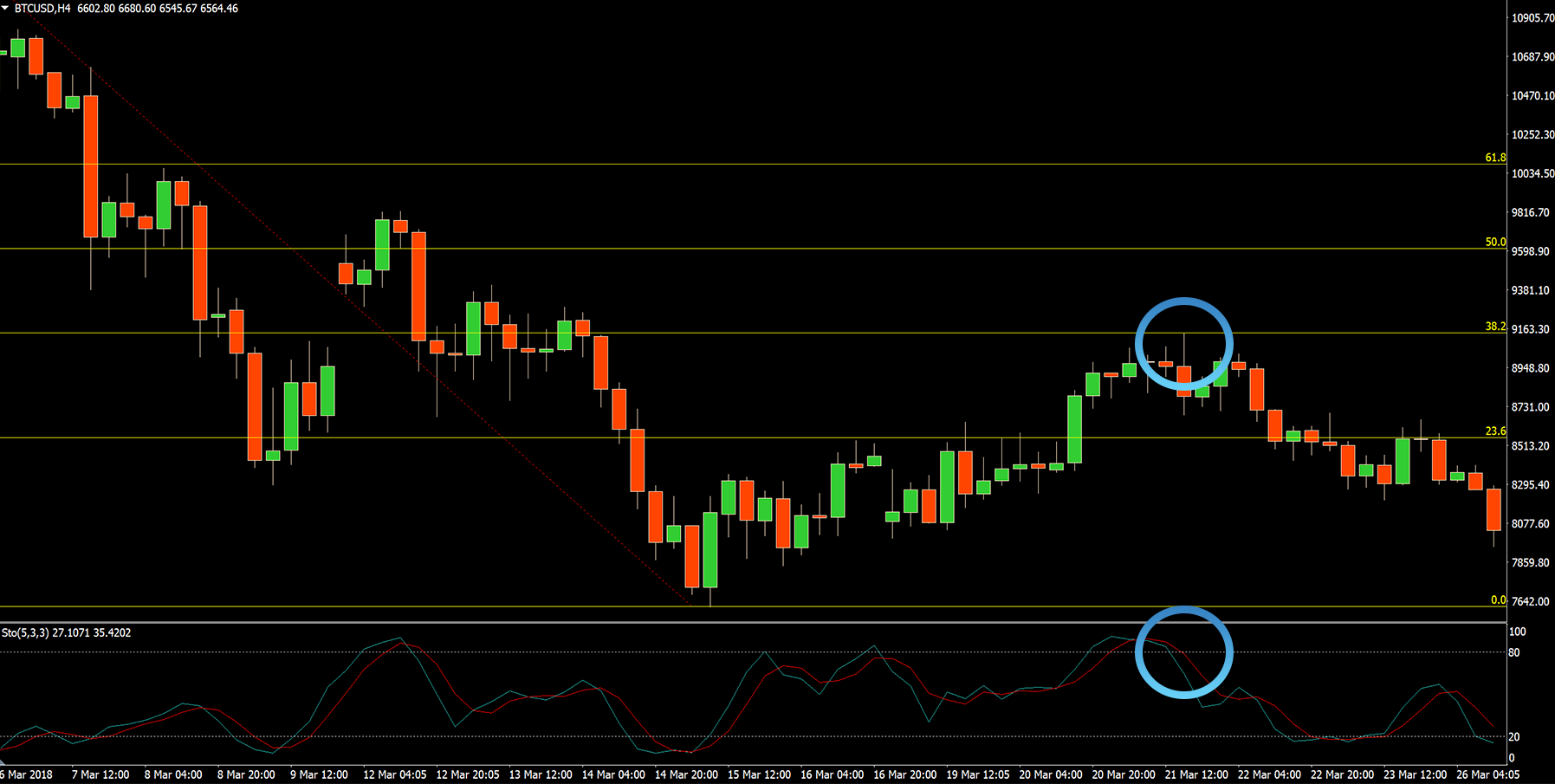

You should not use any of the technical analysis tools in isolation from the others. Similarly, Fibonacci levels are not exact price levels. They are more indicative of the areas where price could potentially react. However, these levels are a powerful pattern for finding the entry and exit points. Stick to this algorithm when using Fibonacci retracement levels in trading: The most commonly used retracement levels are 38.2%, 50%, 61.8% and 78.6%. A common strategy is to buy an asset when its price corrects against the dominant uptrend, reaches the retracement level, and rebounds from it. However, if the price breaks through the level without reversing, the signal is generally disregarded. When correcting against a dominant downtrend, the price may bounce off the correction level and go down again, in which case the asset should be sold. If the price has broken through the 61.8% level—a new trend has started, therefore new correction levels should be built. The trend movement is considered confirmed if the correction depth has stayed within the levels of 38.2%, 50% or 61.8%. Analysts believe these are ideal points for opening and closing positions. Additionally, Fibonacci extension levels, such as 121% and 161.8%, are often used to set take-profit orders, allowing traders to lock in gains as the price moves beyond the previous impulse wave. Like any technical analysis tool, Fibonacci levels require practice. Traders need to practise using them, analyse their failures, and learn from their successes. With experience, Fibonacci levels can become a valuable tool for identifying market trends and making profitable trades. Let's take a look at the Bitcoin four-hour chart:How to trade using Fibonacci levels

Trend continuation strategy using Fibonacci retracements

Here, we can see that the price was in a downtrend before bouncing and retracing exactly 38.2% of the move from the high to the low.

After reaching the 38.2% Fibonacci retracement level, the price reversed and moved lower, resuming the direction of the overriding trend.

The chart shows several different retracement levels marked: 23.6%, 38.2%, 50%, and 61.8%. They all represent potential resistance levels in the context of a retracement of the down move. These levels all represent potential entry points to rejoin the downtrend so we have four potential reversal points to enter the market. But which level should you choose?

This is where knowledge of technical indicators and price action can help you.

Confirmation from secondary indicators

Looking at the chart above, we can see that the Stochastic oscillator gave us a clue that the market was going to reverse. The Stochastics were above the 80 level and curving downward, which is a bearish indicator.

So, with the price up at the 38.2% retracement level and Stochastics giving a sell signal, we're starting to build a good case for placing a sell order, or 'going short' as it is called in the trading industry.

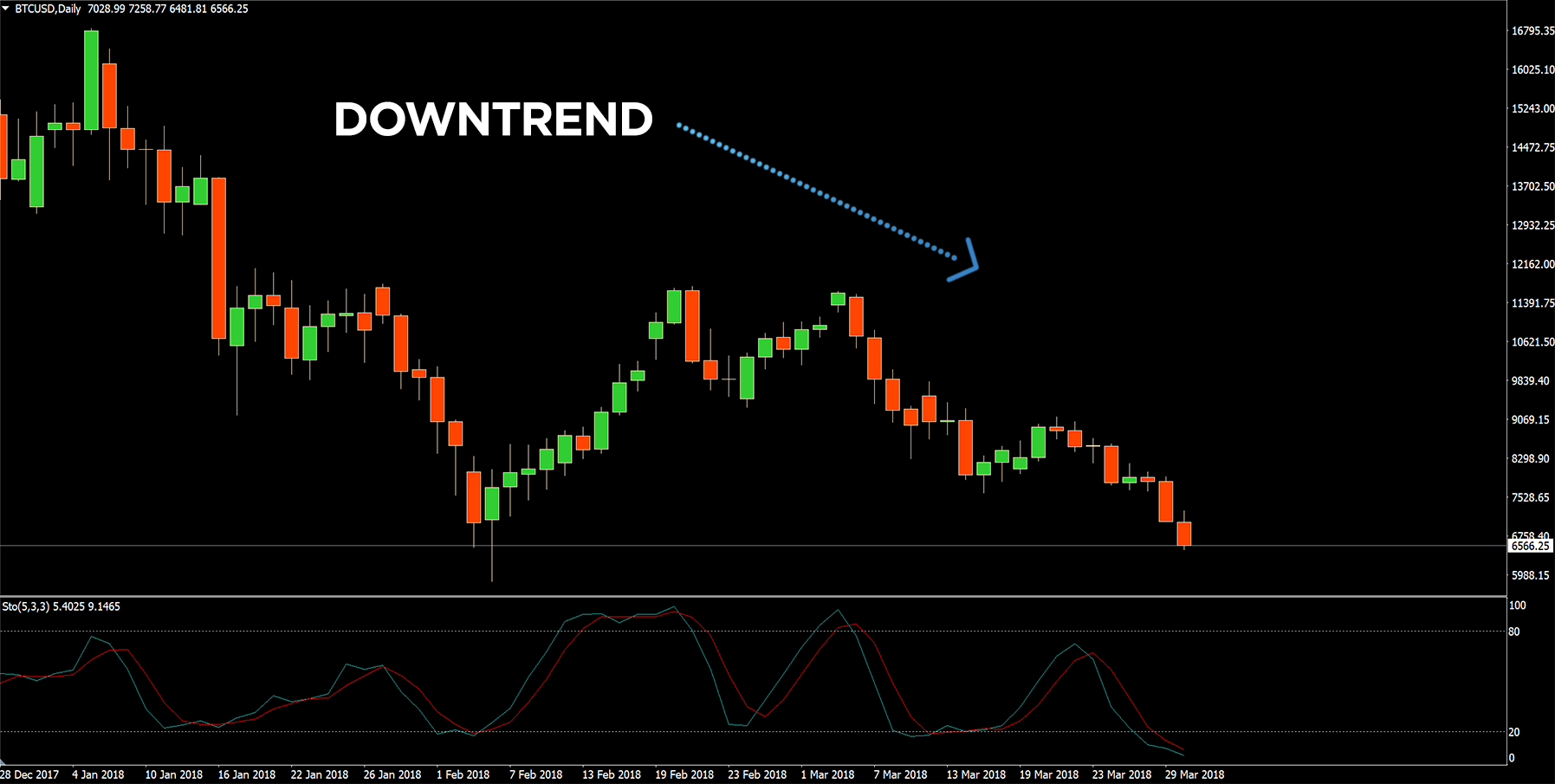

Looking at the trend across multiple time frames

A good trader is a bit like Sherlock Holmes, a detective building up a case based on multiple clues. We've uncovered two good clues for taking a short position, but we're not done yet.

Zooming out for the bigger picture and looking at the daily chart above, we can see that the trend is broadly downward in this timeframe, too.

This further supports the case for selling Bitcoin at the 38.2% Fibonacci retracement level.

For short positions (sell trades) we want to see that the market is in a downtrend across multiple time frames. For long positions (buy trades) we want to see that the market is in an uptrend across multiple time frames.

The bounce off the Fibonacci level on the four-hour chart was relatively large. The 38.2% level was at 9119 and the price sold off all the way down to 8190, a move of over $900.

This is a Forex strategy that can be applied across different time frames. For example, you could look for similar set-ups on a 30-minute chart, instead of the four-hour chart we've used as an example.

Keep in mind that in the shorter time frames, you'll get more signals but they will be less reliable.

Conversely, on longer time frames, you will get fewer signals but they will be more reliable.

Read also: Trading strategies. How to adopt the one to suit your goals in 10 minutes?

To enter the Forex market at Fibonacci retracement levels, you can: Alternatively, you can opt to place the orders manually with a market order when the price reaches the Fibonacci levels. A good rule of thumb is to set a profit target of at least three times your risk. For the Forex trade described above, we could have set our risk to $200 with a profit target of $600. Fibonacci retracements will help you estimate support and resistance areas, but the best use of the tool is to combine it with other indicators and Forex strategies. For instance, you can take advantage of the Stochastic oscillator to define a trend and price reversal. Fibonacci retracements are a trend-following instrument, and looking at the trend across multiple timeframes will obtain a more accurate forecast. Fibonacci retracements make a great confirmation tool and can ensure high probability trades in conjunction with strategies presented in this article. We hope you'll find the best way to trade using Fibonacci retracements.How to enter the Forex market using the Fibonacci trading strategy

Take-profit and stop-loss levels

Final thoughts